Peloton is nothing more than a hardware company masquerading as a software-differentiated one.

There have been a slew of billion dollar companies that have gone public in the past few months, and they all have one thing in common – they want to be tech companies. The outsized success of the largest tech companies have made the industry as a whole seem untouchable. If you’re a tech company, you have to succeed.

Peloton is the newest in a long line of offenders. From their S-1:

Their description has been rightfully memed, but it gives an important look into how the company wants to be valued. As a fitness product they enter a heavily competitive space, but if they are a technology-media-fitness-design-software product then they are truly in a league of their own.

To me, this is the classic example of a non-monopolist claiming monopolist share. From Peter Thiel’s Zero to One:

The fatal temptation is to describe your market extremely narrowly, so that you dominate it by definition. Non-monopolists exaggerate their distinction by defining their market as the intersection of various smaller markets.

He goes on to deride ‘disruption’ as a strategy to differentiate:

The very idea of disruption distorts an entrepreneur’s self-understanding in an inherently competitive way – they see themselves through the older firms’ minds. If you’re making something new, the act of creation is far more important than the old industries that might not like what you create

On the flip side, Ben Thompson (the authority when it comes to technology writing) makes the bull case for Peloton. In his Daily Update he notes that Peloton deserves to be considered as a technology company for a few reasons, one of which because they’re disruptive. He says:

Disruptive technologies, though, make something possible that wasn’t previously, or at a price point that wasn’t viable… Compared to spin classes at a dedicated gym, Peloton is cheap, and it scales far better.

So who’s right?

There are two ways of viewing Peloton’s competitors, and I think the answer varies with which side you believe. Peloton is either competing with the spin classes of the world or they are competing in the broader fitness product space. I believe it’s the latter.

Peloton would love you to believe that they are competing with spin classes because they can define the terms of engagement. But baked into this belief is a fundamental misunderstanding of the spin class target customer. Spin classes are not popular because people have been dying to go biking and can express that desire through indoor biking, but because working out is challenging, tiring, and unpleasant and therefore more pleasant to do with a community.

Subscription classes like SoulCycle or Core Power Yoga thrive because exercise is a prime example of delayed gratification - suffer in the short term, feel good in the long run. Most people struggle to embrace the short term suffering alone, but these shared classes foster a community that encourages exercise and lessens the suffering.

SoulCycle participants know that they would be overpaying if it was merely a cycling class, but it’s not. The candles set the mood for the workout and each instructor has a personal connection with the attendants. SoulCycle enthusiasts buy into the community - their favorite parts of the classes are the instructors they have a personal connection to and the people they see every day.

I am a big believer that online interactions will one day be just as valuable as in-person ones, but I believe exercise will be one of the last frontiers resisting this change. There is something different about people sweating and struggling next to you that a screen will never replace. There’s a reason during BUD/S training, prospective Navy SEALs are all assigned a ‘Swim Buddy’ with who they do everything. Community built through communal suffering will always trump a community built on distributed suffering.

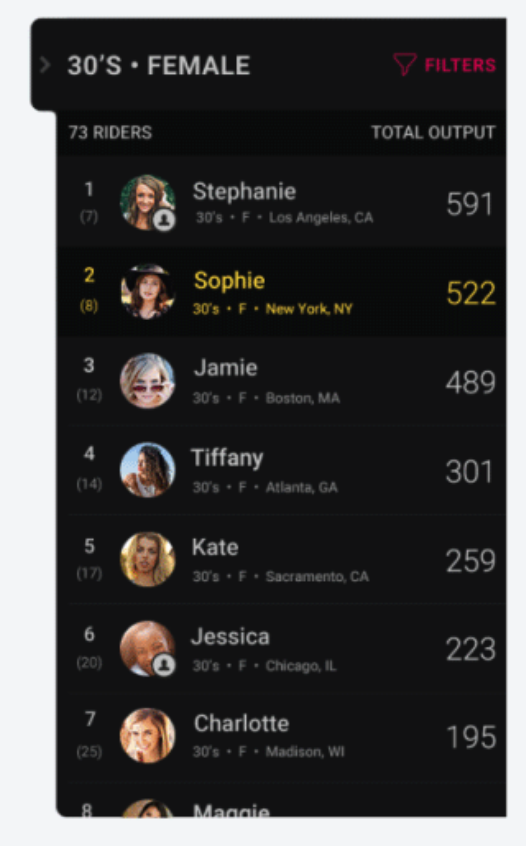

The closest thing Peloton has to a community is their Leaderboard. It shows how users track against every other person who has taken a class before. You can subdivide the leaderboard by gender, age group, etc. to see how you compare to your peers. You can also add friends to your Peloton network to see their exercises and activity.

I am a big fan of gamification – it’s probably my favorite part of the Apple watch – but we cannot confuse competition for community. Striving to beat your friends or strangers encourages engagement, but it doesn’t foster a community. So while it’s tempting to compare Peloton to SoulCycle or other fitness classes, they are both competing for fundamentally different consumers. SoulCyclists and Core Power Yoga enthusiasts are searching for a community and human connection, Peloton users are searching for an alternative to the gym.

This is why I believe the network effects argument for Peloton are so weak. A business/product utilizes network effects when it gets better as more people use it. I wrote previously about how I felt pressured to create a Facebook profile because my friends were posting pictures I really wanted to see. I highly doubt people buy a Peloton because of FOMO. And while it’s better to have more friends on the platform, I do not believe this is a compelling enough reason to join.

Let’s look at Ben Thompson’s final arguments for why Peloton is a tech company:

[Peloton] scales in a way a gym never could: classes are held once and are available forever on-demand; the company has not only digitized space but also time, thanks to technology. This is a tech company.

I have two main problems with this argument: Peloton has not invented home workouts and their technology is neither disruptive nor cutting-edge.

There is a decade-long history of workout programs designed to be done in a living room. Many of them are even household names today: P90X, Insanity, and Bowflex come immediately to mind. In the 1980s Jane Fonda released her famous video ‘Jane Fonda’s Workout’ which is credited for starting the whole aerobics movement. If there is any company that should be credited with digitizing space and time it should be YouTube.

The problem with home fitness is not that there is a lack of resources, it’s that there are too many programs to choose from. YouTube has created a generation of fitness influencers that have extensively covered nutrition, sleep, and supplementation on top of videos of workouts. These are all FREE to access and are arguably of higher quality than Peloton instructors. I personally prefer Jeff Cavaliere and Chris Heria, but the beauty of YouTube is everyone can choose for themselves. Furthermore, these influencers are not limited to exercises that can be done on a singular exercise bike so they appeal to a much wider audience.

Peloton isn’t even the first high-end company in the home fitness space. A Bowflex can run anywhere between $600-3,000 which keeps in firmly in the range of Peloton’s product. It is conceivable to argue that Peloton is the first mover to scale in the digital age, but I do not believe their position is defensible in the long-run.

Watching a video instructing you how to bike while biking is a concept so basic that it seems more 1900s than the 21st century. They are so behind in terms of utilizing technology that only their price tag gives them any illusion of superiority. Their CEO John Foley has mentioned that original Peloton users were put off by ‘how cheap’ they were, so they raised their price.

They’ve made a $1,000 bike and they charge $2,000 for it. It’s a great business model, but hardly disruptive compared to some home fitness companies and products that I think are truly pushing the boundaries.

Tonal is a home fitness product that adjusts to your current and past performance. The product monitors your rep, the quality of your rep, the quality of your past reps, and adjusts the resistance of the cable as you’re in the middle of a set. As any athlete knows, there are a lot of different factors that go into a training session. If you sleep worse one night or you’ve had poor nutrition during the day you can underperform. By adjusting to your current performance, Tonal ensures you’re getting the most out of every workout.

They also include coaching that adapts to your performance as well. To steal the phrase from Ben Thompson, Tonal has digitized space, time, and performance. As a former national and college athlete, this is the type of training that pushes people to improve, not a pre-recorded video of a cycling class.

Tonal is not the only company using technology to transform how we exercise. Venture and Disney-backed Aaptiv has released Aaptiv Coach, an AI-based assistant that personalizes advice based on your daily habits. CEO Ethan Agarwal described the goals of Aaptiv Coach ahead of their launch (emphasis mine):

If you work out three times a week for 45 minutes, that is basically 2% of your week. But there are a lot of companies competing for that 2%: gyms, in-house biking startups, and more. But the way we see it, it is that the other 98% of the time is where your habits are formed, where you need to build structure.

Money is scalable, but time is finite. As people become more health and fitness conscious, companies will continue to compete for people’s limited time and attention. Ultimately, I believe people will choose the product/services that bring them the most return for their time. Peloton’s offerings are not differentiated enough to sustain any competitive moat.

People who have bought Pelotons will continue to use them. I believe the $2000 upfront cost precludes many of them from immediately switching, but as competition increases people will choose to use superior products and eventually people will move off the service. In-home biking is too specific, too undifferentiated, and ultimately will become too inefficient to dominate the market.

Attaching an iPad on an exercise bike is a classic example of horizontal progress (1 to n) – taking something we know well and distributing it everywhere. It is not creating something new or market defining (zero to one), and therefore is not technology. I am excited about the future of home fitness, but I don’t believe Peloton in its current state belongs in the long term future.

Thanks to Kevin Arifin, David Liu, and Ninan Kumar for reading a draft of this.