Much has been made of Apple’s new services. To give a brief summary Apple has four new products:

- Apple News Plus - a manually curated aggregated news experience that does not share your data with advertisers

- Apple Card - the titanium and virtual card powered by Mastercard and Goldman Sachs

- Apple TV Plus - details are scarce on how it will roll out, but expect bundling to accompany original content as Apple enters a crowded space with Netlfix, Amazon, and the not-yet released Disney+

- Apple Arcade - a video game subscription service that will give access to a bundle of games for one monthly fee. While this may be successful, I’m uninterested in this product because Apple has mandated all games in the service be iOS, macOS, and tvOS compatible. This means it’s highly unlikely we will see any AAA games on the service.

This shift to services deviates from Apple’s mainstream product releases, but remains true to Apple’s main objective - to increase touch points with the core base of customers. And thus, it reminds me of a classic private equity growth initiative. There are 5 billion adults in the world and almost a billion iPhone users.

Apple has been primarily an iPhone company, and as it slowly saturates world market it needs to find new places to grow. This problem resembles a lot of my work in private equity.

In my time at Inoca Capital, I’ve looked at over 2000 deals and worked intimiately with our two portfolio companies. None of them were as fortunate or as successful as Apple in creating a captivated userbase, but they faced a similar problem in figuring out how to get clients to pay more than they signed up for. Apple’s pivot to services screams private equity, I’ll evaluate the strategy below.

How to Boost Returns to Shareholders

This is an oversimplification of the highest order, but barring multiple expansion (which means you assume you get the same exit multiple as entry) there are two key ways of boosting returns: earn more revenue, or increasing operational efficiency. While there is room for creativity in the second role, it is often in the first where founder CEOs get lost. When there’s an abundance of potential strategies, picking the right one and executing like crazy is extremely difficult for even the best CEOs (see Steve Jobs initially failing at Apple).

When trying to grow the top line, there are generally two levers:

- Net new sales - this is generally the hardest and least desirable mandate for a sales team

- Follow-on sales - the staple of consulting, this is completing a project or service for a consumer/client and tacking on additional services at the end

The reason the second lever is far more desirable than the first is it’s infinitely easier to get a consumer to agree to spend the second dollar than the first, and by increasing their dependence it increases the ‘stickiness’ of your brand. Apple has done a remarkable job of this with their products. Homepods can only search within Apple music, AirDrop only works between Apple products, and even iMessages shuns Android users by making conversations take a different color. Apple music was the first and most successful move Apple has taken in the services space. And after passing Spotify in the United States, it’s been very successful. I believe this proof of concept allowed Apple to continue to expand into other services.

Why Services are Essential

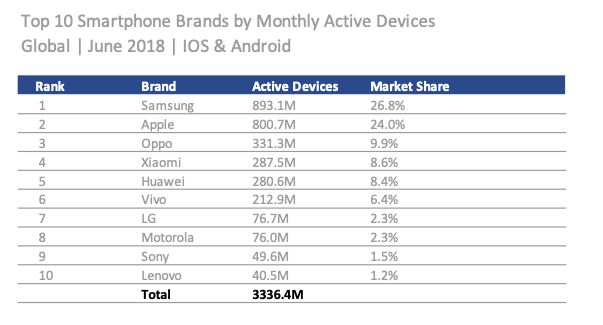

Much to Elizabeth Warren’s chagrin, oligopolies are in, and small service providers are out. Apple and Samsung have dominated the smartphone market and with the exception of Chinese-backed phones, it will be hard to knock off the incumbents. The rest of the media and entertainment space, however, is consolidating. I believe Apple is launching their services to either get ahead of these changes before it is too late. Here’s how I see each of their services playing a role in their future.

Apple TV Plus - the success of this unit will be very telling towards Apple’s influence in realms other than consumer products. Disney’s merger with Fox and Netflix spending $12 billion on content leaves little room for smaller players. Hulu has partnered with Spotify and content such as HBO are available through a variety of providers. In a way, Amazon has provided the framework for what I expect Apple to unveil. Free access to those with Apple TV or specific other devices, and probably some form of bundling with their other services. With Apple shelling out for celebrity endoresements and participation, it’s clear that they will put the necessary money behind competing with the established and soon-to-be established streaming providers.

Apple News Plus - this follows a pretty obvious parallel to Apple TV plus and the entertainment industry. If it’s complicated for people to find which news sources to subscribe to, then Apple will make it easy by aggregating them into a one stop news source. No ads and no tracking makes it easier for users to trust Apple. Benedict Evans and Steven Sinofsky of a16z talk at length about the news plus, and it’s worth a listen to here.

Apple Arcade - I could see this as being a relatively cheap add on to the other services, like a family friendly gaming add on the Apple TV. Without AAA games, I don’t see many of the games being streamable which I think is the future of gaming, and it will lack the expansive RPG single player games.

Apple Card - the one card to rule them all. Jokes aside, the Apple card is great for those who aren’t avid The Points Guy (TPG) followers as it’s simple, secure, and has no fees. Instagram’s native payments was an obvious next step, and more and more companies are figuring out how to keep you within their ecosystem (Snap cash, facebook messenger payments, etc). By taking Apple Pay to the next step Apple further insulates its customer base from other brands.

Apple has done a great job of creating a ecosystem of products that function better together, and is now tying them together with services that complement. We can think of these services similar to the app store. At first, the app store’s purpose was to sell more iPhones. Apple takes a 30% cut from app store purchases which was negligible to begin with, but as weekly users of the App store increased to 500mm that became a real number. These services will generate incremental or negligible (especially with free trials), but with time will provide real and stable cash flows. It looks like the market has taken these announcements favorably, and with innovation in iPhones declining I’m interested in seeing if this is the future of Apple.